Program and Breach Coverrage

We want to make this process as easy and affordable to our merchants as possible. Most small and medium sized businesses are Level 4 merchants. Level 4 merchants are businesses processing less than 1 million retail transactions a year or less than 20,000 ecommerce transactions per year. For these merchants, compliance can be as easy as filling out a self-assessment questionaire.

Our PCI program is included as part of all of our new merchant services and packages, built-in our monthly fee. Unlike most processors, we do not charge any quarterly or annual PCI fees.

Start an Application Online

Are you interested in a complete POS System or just specific components?*

Our Partners

We've partnered with Sysnet and Trustwave, two of the world's top security companies. They provide the portal, questionnaires, reviews, security scans and compliance certificates. Outside of our PCI program, businesses can also employ their services if additional consultations or audits are needed.

$100,000

Breach Coverage

We provide our compliant Level 4 merchants with a $100,000 breach coverage in the form of fee mitigation. This means that in the event of a breach, up to $100,000 of fines levied by the card-brands will be covered. Another reason for merchants to get compliant!

Non-compliance

Merchants have 90 days from approval to show proof of their compliance for each merchant ID. For the majority of merchants, this is as easy as filling out a basic online questionnaire. Merchants who fail to complete their compliance are subject to a $30 per month non-compliance penalty. While non-compliance fees are never fun, as a processor we are required to meet certain compliance levels of our merchant base, and a non-compliance fee is an effective way to motivate merchants to complete their compliance.

TOP TIPS to Make PCI Compliance Easier

It’s not worth it! Sensitive cardholder information includes credit card numbers, expiry dates, security code (CVV) and mag-stripe data. If you need to keep your customers’ billing information on file to bill them later, we have great tools including our secure Card Vault that lets you use the card anytime while transferring the security liability over to us.

Get in the habit of changing your passwords every 30 days and using complicated passwords with letters, numbers and special characters (sentences are even better!). While having so many complex passwords can seem daunting, there are great tools like LastPass.com or free open-source programs like KeePass.info that can store your passwords and generate new ones on the fly.

Over the years, customers have gotten used to leaving the merchant website to enter their credit card information. Some customers even expect it. By removing the credit card entry from your website and using a secure hosted payment page, you reduce your liability and scope of compliance.

Having up-to-date anti-virus software on your computer is a must, but merchants should also consider a good software firewall (a popular option is ESET’s SmartSecurity). Wouldn’t you like to know every time a new program is trying to send data out of your computer?

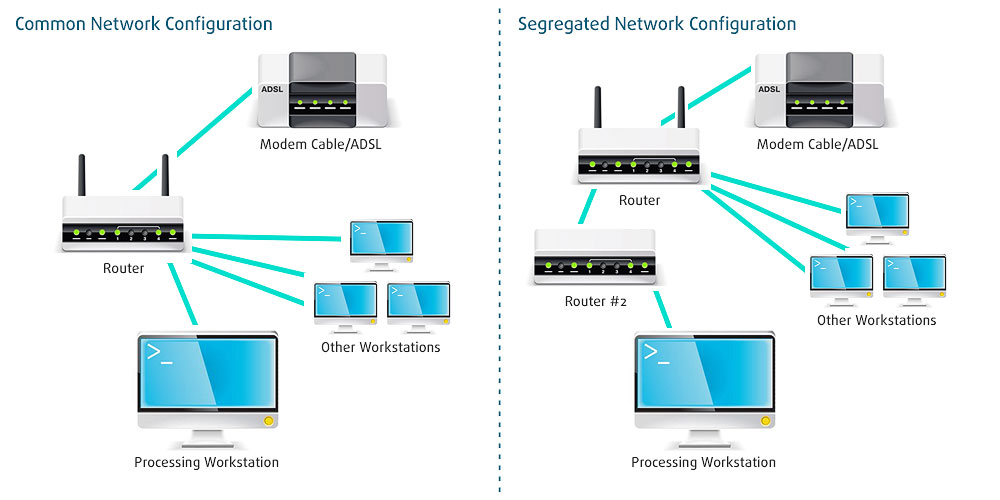

If you are using a Virtual Terminal or a Internet-based terminal, part of the PCI compliance standard is to have a separation of the network. Sounds complicated? It can be as easy as getting a separate wired router for your office. This is a great and very cheap way of increasing your security. Use the diagram below as a reference.